The Gap Between Selling and Shipping: Why OEMs Face Welding Bottlenecks After the PO (And How to Fix It).

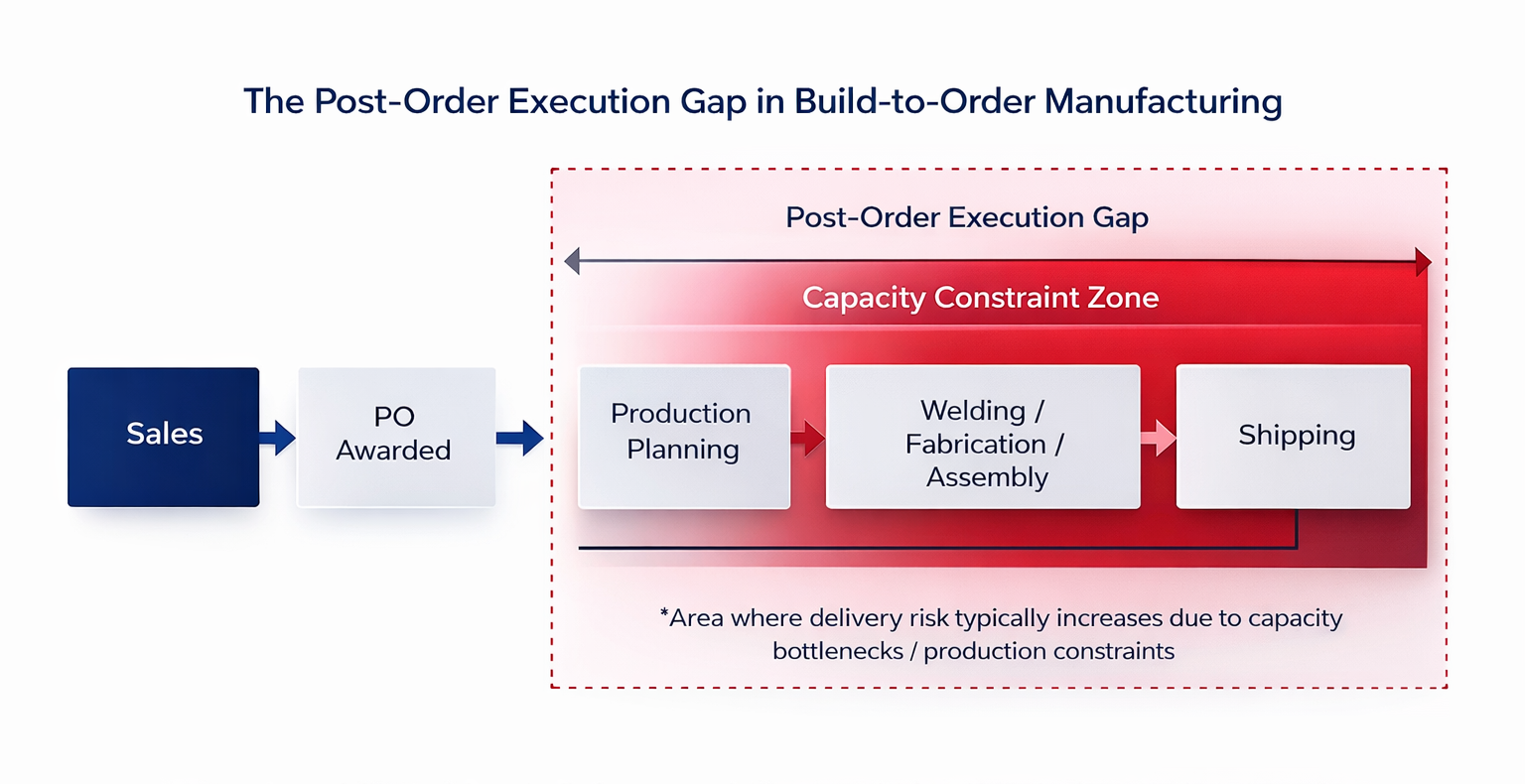

The Post-Order Execution Gap in Build-to-Order Manufacturing

Most build to order OEMs can fall into categories like small batch changeovers, seasonal surges, compliance requirements, line balancing, etc.

Surprisingly, they don’t contact outside welding or fabrication support while they’re planning a sale.

They call after the sale is already done.

By the time the conversation starts, one or more of the following is already true:

The purchase order has been awarded and you need Greenville Weld Company to help weld out your product like we’ve done with Wins Smokehouse Services.

Material is staged on the shop floor but itis not moving & you need Greenville Weld Company to quickly finish the production process and get a final product back to your team ASAP like we did for Stokes Technology Group.

Internal timelines are tightening and you have already made attempts at hiring the additional workers, but found out that you need a specialized craft to help finish - This is how we got ARA in position to ship their product to their customer ON TIME.

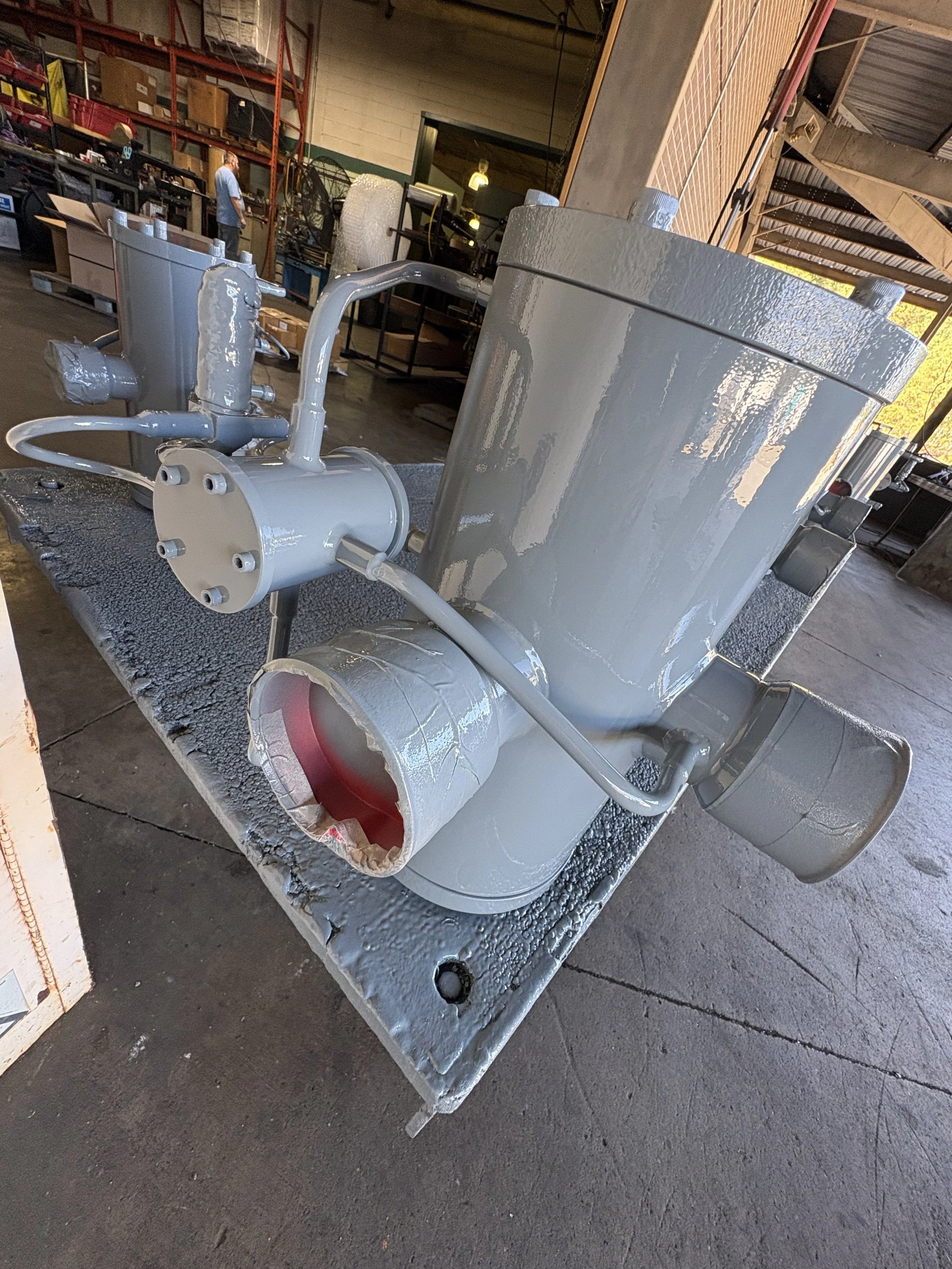

Production capacity is quietly saturated - This is the silent killer that interacts with shop ego, and we still delivered for PE Valve, shipping a hundred valves this year.

It’s the moment welding and assembly are no longer just part of the process. They become the constraint between “we sold it” and “we shipped it.”

Greenville Weld Company steps in as an extra welding and assembly cell between your PO and your shipping dock—taking defined welded subassemblies off your line so you can ship on time without hiring or bringing in traveling rig welders.

That gap is where delivery risk lives.

The Patterns We See in Build-To-Order OEMs

Most of the OEMs we work with are not high-volume production plants.

They sell finished products or systems, build in cycles, and experience production spikes after approvals or purchase orders land.

Their internal teams are usually capable. They’re just not elastic in terms of WIP, or "work in progress”.

lacking of certified welders & reliance on traveling rig welders

overtime fatigue of internal teams & last‑minute welding capacity crunch when orders spike

quality degradation from rushed welds

needing temporary cells for a large orders

Capacity is sized for average demand, not peak sales. So when sales hit, the production crew feels it quickly. Production gets swamped.

That’s when problems surface.

Greenville Weld Company acts as an off‑the‑shelf welding cell you can turn on and off as needed, without adding company headcount or searching for travelers.

Common Welding and Fabrication Bottlenecks After a PO Is Awarded

The first warning sign is often physically visible.

Material arrives. Parts are cut. Subassemblies are partially completed. On paper, production has started. In reality, throughput has hit a ceiling.

Welding and assembly — the phases that actually convert material into finished product — can begin to lag behind everything upstream.

And at first, this doesn’t feel urgent.

There’s still time on the schedule. Everyone assumes things will catch up.

But they rarely do.

Why Internal Capacity Stops Scaling During Peak Production Loads

The tone changes the moment delivery dates become firm and dates aren’t adding up.

A customer asks for confirmation. A project manager wants a committed ship date.

What was once adjustable becomes fixed.

At that point, adding urgency doesn’t add capacity.

Internal crews are already fully loaded. Pulling one person off another task simply moves the bottleneck elsewhere. Small quality issues start to appear. Management attention shifts from planning to firefighting.

Production isn’t broken, it is swamped.

The Hidden Fragility Inside Most Shops

Many OEM environments rely heavily on one or two key individuals:

One welder who really knows the process

One fitter who understands the right sequence

One foreman who keeps everything aligned and moving.

As long as that person is available, the operation holds together.

When they’re overloaded — or pulled into something else — the schedule becomes fragile.

This is often the moment leadership starts looking for redundancy they can trust.

When Welding Isn’t the Problem — Execution Is

By the time companies reach out, they usually realize the issue isn’t welding alone.

It’s execution.

In many builds, welding is embedded inside a longer sequence:

• Engineering

Fabrication

Assembly

What’s needed isn’t just additional labor.

It’s a team that can step into that sequence, respect how it’s designed, and move it forward without creating more coordination overhead.

This is also where many OEMs grow frustrated with traditional staffing solutions.

Supplying labor doesn’t solve sequencing. It adds supervision at the worst possible production capacity.

The Cost of Getting It Wrong

When capacity constraints are handled poorly, the consequences compound quickly:

Rework begins eating schedule

Parts get touched multiple times

Quality slips under pressure

Management bandwidth disappears into recovery

At that point, the cost isn’t just financial.

It’s reputational.

Most OEMs don’t call for help when things are calm.

They call when disorder starts creeping into delivery.

Here’s Proof Of What Companies Are Actually Buying

Proof #1 - Christmas 2025 Challenge:

When one OEM reached out during this moments, they weren’t buying welding hours.

A regional OEM in Upstate SC running small‑batch, built‑to‑order equipment.

They landed a rush order that would have overloaded their two in‑house welders.

They faced a choice: overtime and burnout, hiring temporary welders, or delaying shipment.

Instead we delivered the order before Christmas, when their team couldn’t have touched it until mid-January.

The time from approved quote to a delivered product, including powder coat, was one week.

We added 0% of welding queue time for them, kept their promised ship date, and avoided adding permanent staff.

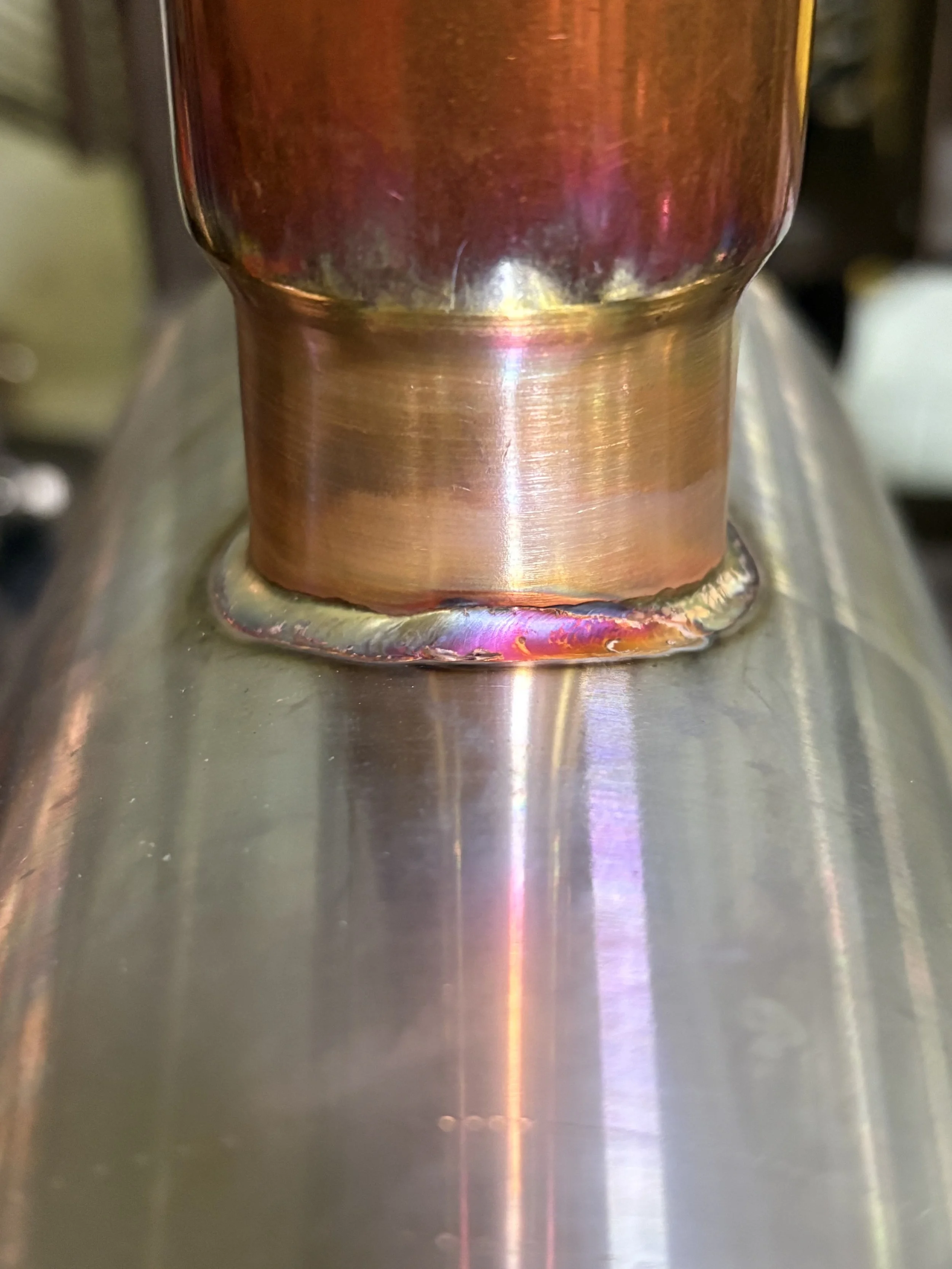

Proof #2 - Customer Needed High End Tig Welders for Large Custom Order:

Another OEM has us on site for more than 6 months out of the year supporting their existing production team. He has shipped multiple 7 figure products this year.

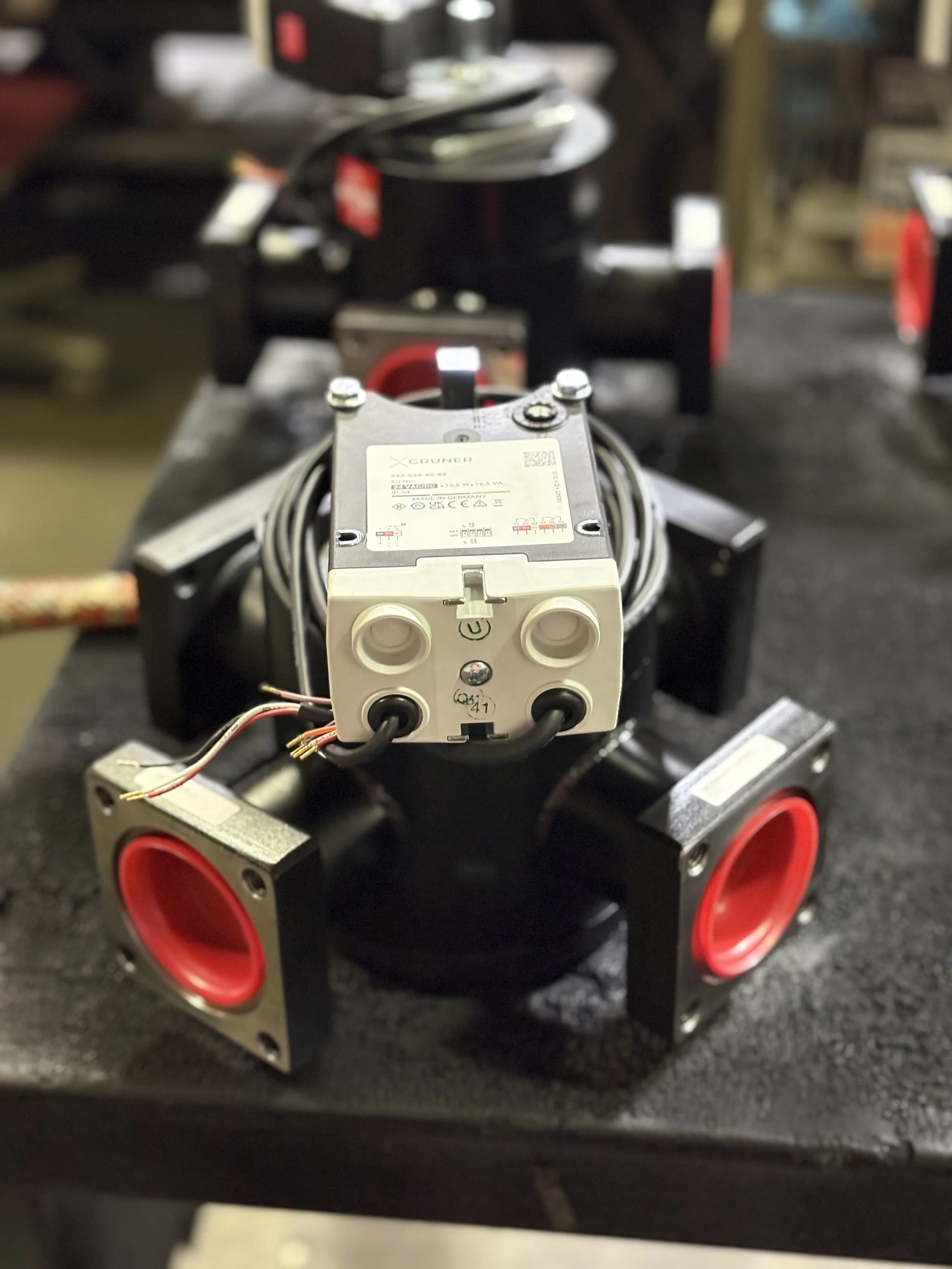

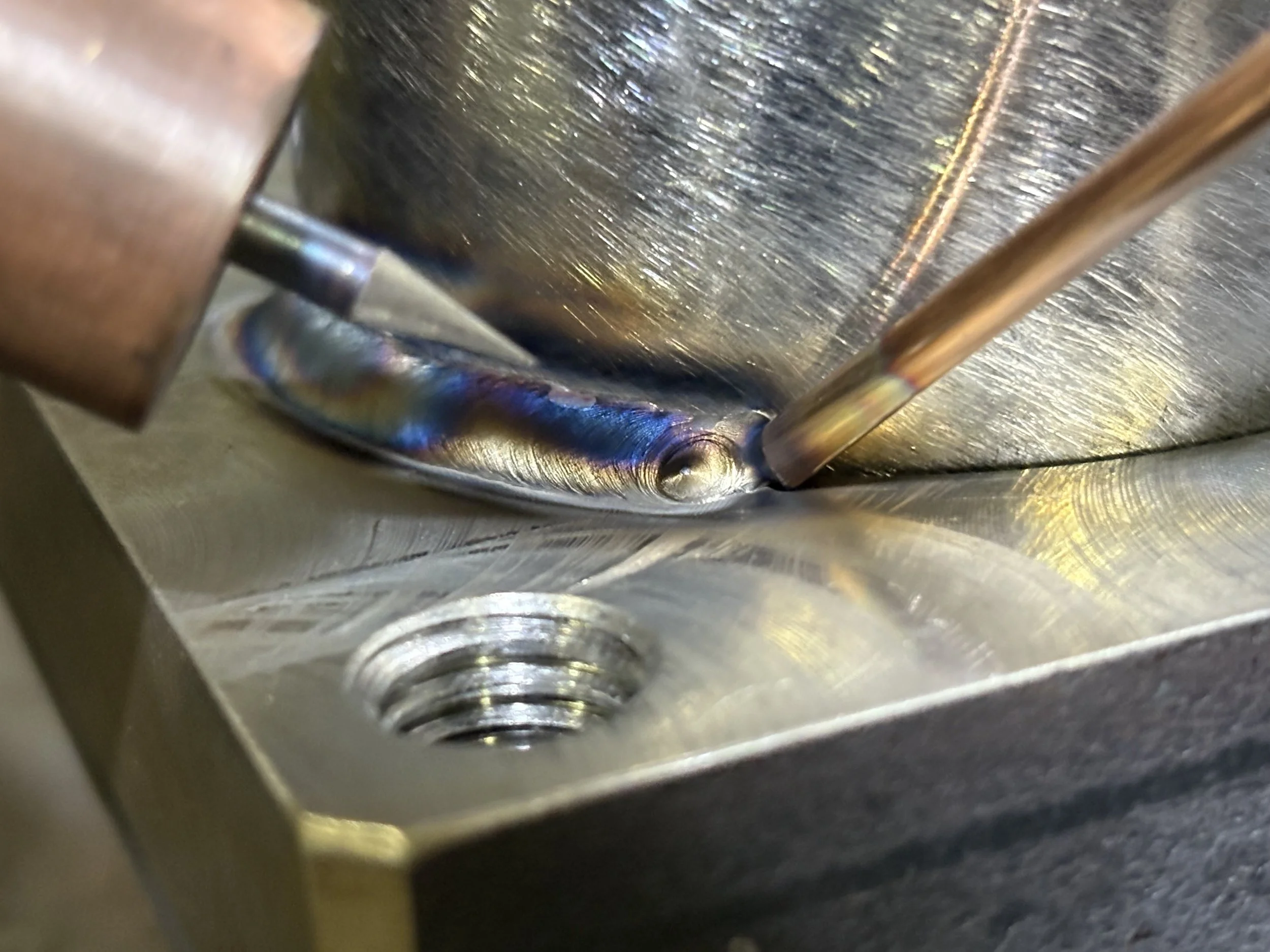

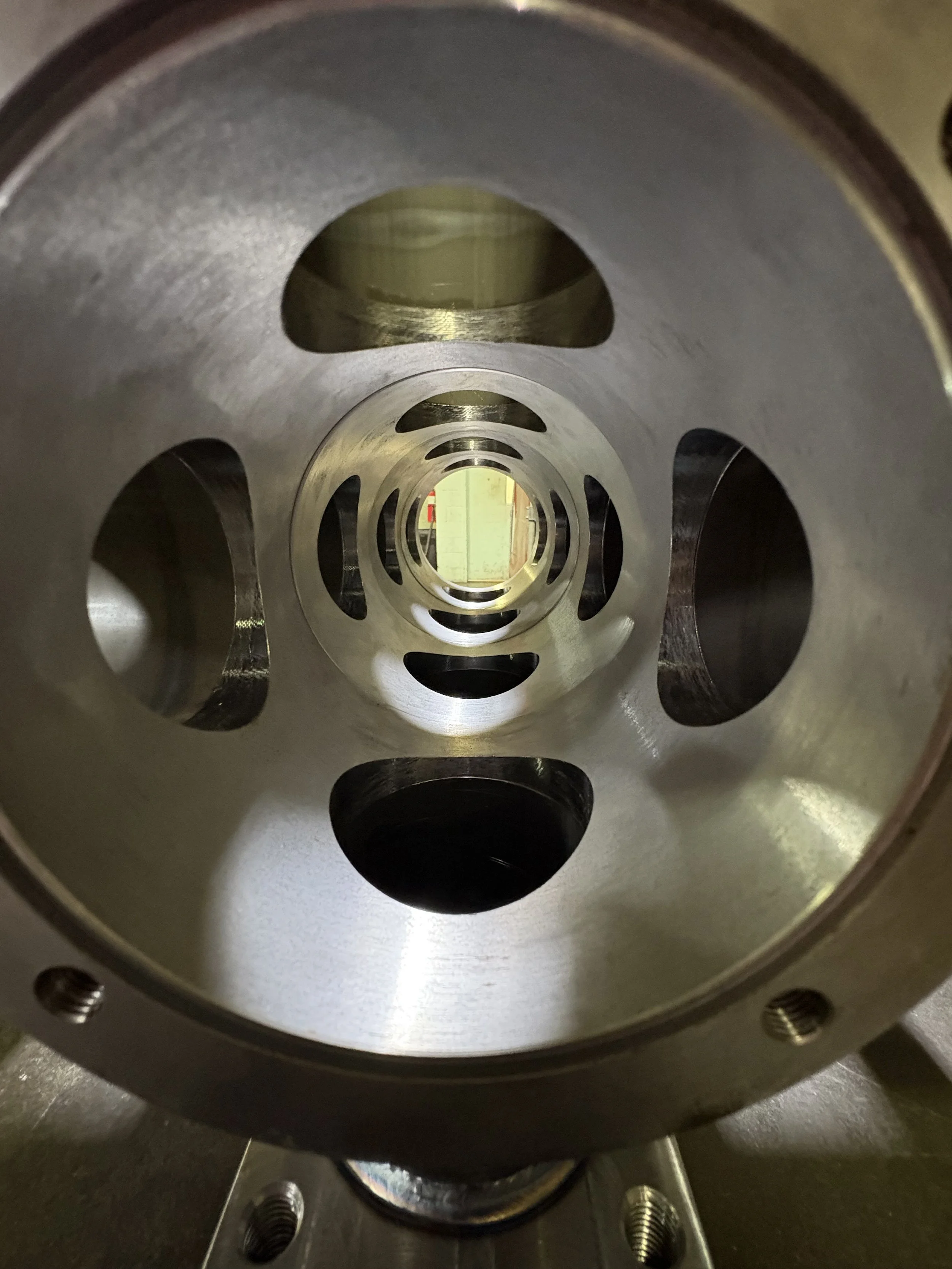

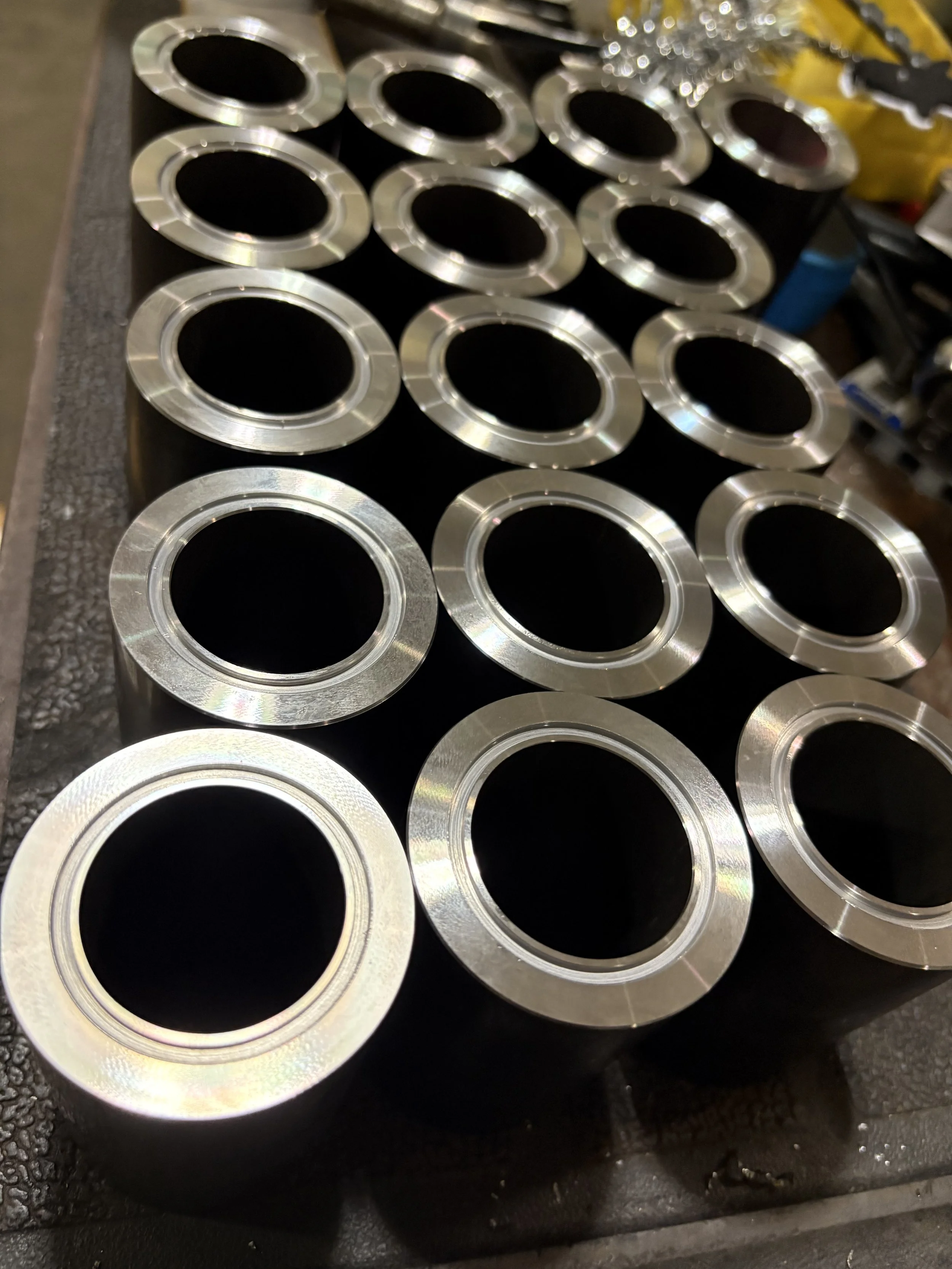

We have many more examples of this work flow pictured below:

Where Greenville Weld Company Fits In

Greenville Weld Company partners with build to order OEMs whose productions teams get swamped once a PO hits.

No permanent hires required to cover peak demand

No traveling crews unfamiliar with your standards

Seamless integration into existing sequences and shop rules

Limited partnerships to ensure execution ownership and attention

When your forecasted orders push your welding hours above a normal load for more than a few weeks, you’re in the risk zone for slipped shipments; at that point, pre‑building repeat weldments externally often saves money compared to adding a shift.

Or if your weld inspectors/supervisors are spending more time on rework than on first‑article approvals, it’s a sign the work is overloaded and needs to be split between in‑house and an external partner

We don’t replace internal crews. We don’t redesign products mid-stream.

We integrate into existing processes, follow your drawings and standards, and can take ownership of fabrication, welding, and assembly phases that tend to bottleneck delivery.

But because this model requires deep integration, we intentionally limit how many OEMs we support at any given time.

Not every environment is a fit — and that’s by design.

To learn more about how we retain competent welders, just click here.

Or use this form to start a quick capacity review — no purchasing commitment, just a practical conversation about where welding is slowing down your shipping dates.